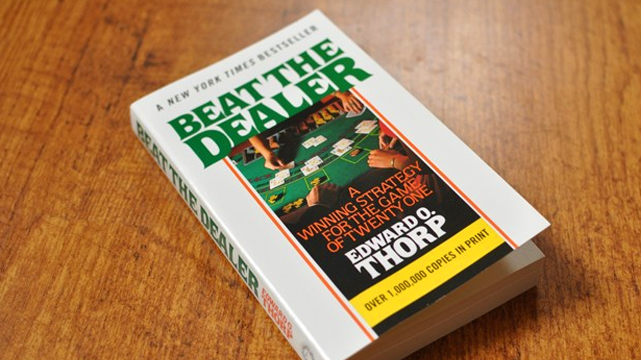

As mentioned in our article on Bill Benter, Edward Thorp was made famous through his book Beat the Dealer. Thorp brought the phenomenon of card counting to light when his book was released in 1962, selling over 700,000 copies and making it onto the New York Times Bestsellers list. 1 – Edward Thorp. Edward Thorp is a math professor who literally wrote the book on card counting. Beat the Dealer was the first book about card counting that mathematically demonstrated that you could beat the house edge in blackjack by tracking the ratio of high cards to low cards left in the deck.

| Born | August 14, 1932 (age 88) Chicago, Illinois, U.S. |

|---|---|

| Citizenship | American |

| Alma mater | UCLA |

| Scientific career | |

| Fields | Probability theory, Linear operators |

| Institutions | UC Irvine, New Mexico State University, MIT |

| Thesis | Compact Linear Operators in Normed Spaces(1958) |

| Doctoral advisor | Angus E. Taylor |

| Influences | Claude Shannon |

Edward Oakley Thorp Lake tahoe nevada casino resorts. (born August 14, 1932) is an American mathematics professor, author, hedge fund manager, and blackjack researcher. He pioneered the modern applications of probability theory, including the harnessing of very small correlations for reliable financial gain.

Thorp is the author of Beat the Dealer, which mathematically proved that the house advantage in blackjack could be overcome by card counting.[1] He also developed and applied effective hedge fund techniques in the financial markets, and collaborated with Claude Shannon in creating the first wearable computer.[2]

Thorp received his Ph.D. in mathematics from the University of California, Los Angeles in 1958, and worked at the Massachusetts Institute of Technology (MIT) from 1959 to 1961. He was a professor of mathematics from 1961 to 1965 at New Mexico State University, and then joined the University of California, Irvine where he was a professor of mathematics from 1965 to 1977 and a professor of mathematics and finance from 1977 to 1982.[3]

Computer-aided research in blackjack[edit]

Thorp used the IBM 704 as a research tool in order to investigate the probabilities of winning while developing his blackjack game theory, which was based on the Kelly criterion, which he learned about from the 1956 paper by Kelly.[4][5][6][7] He learned Fortran in order to program the equations needed for his theoretical research model on the probabilities of winning at blackjack. Thorp analyzed the game of blackjack to a great extent this way, while devising card-counting schemes with the aid of the IBM 704 in order to improve his odds,[8] especially near the end of a card deck that is not being reshuffled after every deal.

Applied research in Reno, Lake Tahoe and Las Vegas[edit]

As mentioned in our article on Bill Benter, Edward Thorp was made famous through his book Beat the Dealer. Thorp brought the phenomenon of card counting to light when his book was released in 1962, selling over 700,000 copies and making it onto the New York Times Bestsellers list. 1 – Edward Thorp. Edward Thorp is a math professor who literally wrote the book on card counting. Beat the Dealer was the first book about card counting that mathematically demonstrated that you could beat the house edge in blackjack by tracking the ratio of high cards to low cards left in the deck.

| Born | August 14, 1932 (age 88) Chicago, Illinois, U.S. |

|---|---|

| Citizenship | American |

| Alma mater | UCLA |

| Scientific career | |

| Fields | Probability theory, Linear operators |

| Institutions | UC Irvine, New Mexico State University, MIT |

| Thesis | Compact Linear Operators in Normed Spaces(1958) |

| Doctoral advisor | Angus E. Taylor |

| Influences | Claude Shannon |

Edward Oakley Thorp Lake tahoe nevada casino resorts. (born August 14, 1932) is an American mathematics professor, author, hedge fund manager, and blackjack researcher. He pioneered the modern applications of probability theory, including the harnessing of very small correlations for reliable financial gain.

Thorp is the author of Beat the Dealer, which mathematically proved that the house advantage in blackjack could be overcome by card counting.[1] He also developed and applied effective hedge fund techniques in the financial markets, and collaborated with Claude Shannon in creating the first wearable computer.[2]

Thorp received his Ph.D. in mathematics from the University of California, Los Angeles in 1958, and worked at the Massachusetts Institute of Technology (MIT) from 1959 to 1961. He was a professor of mathematics from 1961 to 1965 at New Mexico State University, and then joined the University of California, Irvine where he was a professor of mathematics from 1965 to 1977 and a professor of mathematics and finance from 1977 to 1982.[3]

Computer-aided research in blackjack[edit]

Thorp used the IBM 704 as a research tool in order to investigate the probabilities of winning while developing his blackjack game theory, which was based on the Kelly criterion, which he learned about from the 1956 paper by Kelly.[4][5][6][7] He learned Fortran in order to program the equations needed for his theoretical research model on the probabilities of winning at blackjack. Thorp analyzed the game of blackjack to a great extent this way, while devising card-counting schemes with the aid of the IBM 704 in order to improve his odds,[8] especially near the end of a card deck that is not being reshuffled after every deal.

Applied research in Reno, Lake Tahoe and Las Vegas[edit]

Thorp decided to test his theory in practice in Reno, Lake Tahoe, and Las Vegas.[6][8][9]Thorp started his applied research using $10,000, with Manny Kimmel, a wealthy professional gambler and former bookmaker,[10] providing the venture capital. First they visited Reno and Lake Tahoe establishments where they tested Thorp's theory at the local blackjack tables.[9] The experimental results proved successful and his theory was verified since he won $11,000 in a single weekend.[6] Casinos now shuffle well before the end of the deck as a countermeasure to his methods. During his Las Vegas casino visits Thorp frequently used disguises such as wraparound glasses and false beards.[9] In addition to the blackjack activities, Thorp had assembled a baccarat team which was also winning.[9]

News quickly spread throughout the gambling community, which was eager for new methods of winning, while Thorp became an instant celebrity among blackjack aficionados. Due to the great demand generated about disseminating his research results to a wider gambling audience, he wrote the book Beat the Dealer in 1966, widely considered the original card counting manual,[11]which sold over 700,000 copies, a huge number for a specialty title which earned it a place in the New York Times bestseller list, much to the chagrin of Kimmel whose identity was thinly disguised in the book as Mr. X.[6]

Thorp's blackjack research[12] is one of the very few examples where results from such research reached the public directly, completely bypassing the usual academic peer review process cycle. He has also stated that he considered the whole experiment an academic exercise.[6]

In addition, Thorp, while a professor of mathematics at MIT, met Claude Shannon, and took him and his wife Betty Shannon as partners on weekend forays to Las Vegas to play roulette and blackjack, at which Thorp was very successful.[13]His team's roulette play was the first instance of using a wearable computer in a casino — something which is now illegal, as of May 30, 1985, when the Nevada devices law came into effect as an emergency measure targeting blackjack and roulette devices.[2][13] The wearable computer was co-developed with Claude Shannon between 1960–61. Online poker micro stakes. Thefinal operating version of the device was tested in Shannon's home lab at his basement in June 1961.[2] His achievements have led him to become an inaugural member of the Blackjack Hall of Fame.[14]

He also devised the 'Thorp count', a method for calculating the likelihood of winning in certain endgame positions in backgammon.[15]

Stock market[edit]

Since the late 1960s, Thorp has used his knowledge of probability and statistics in the stock market by discovering and exploiting a number of pricing anomalies in the securities markets, and he has made a significant fortune.[5] Thorp's first hedge fund was Princeton/Newport Partners. He is currently the President of Edward O. Thorp & Associates, based in Newport Beach, California. In May 1998, Thorp reported that his personal investments yielded an annualized 20 percent rate of return averaged over 28.5 years.[16]

Bibliography[edit]

- (Autobiography) Edward O. Thorp, A Man for All Markets: From Las Vegas to Wall Street, How I Beat the Dealer and the Market, 2017. [1]

- Edward O. Thorp, Elementary Probability, 1977, ISBN0-88275-389-4

- Edward Thorp, Beat the Dealer: A Winning Strategy for the Game of Twenty-One, ISBN0-394-70310-3

- Edward O. Thorp, Sheen T. Kassouf, Beat the Market: A Scientific Stock Market System, 1967, ISBN0-394-42439-5 (online pdf, retrieved 22 Nov 2017)

- Edward O. Thorp, The Mathematics of Gambling, 1984, ISBN0-89746-019-7 (online version part 1, part 2, part 3, part 4)

- Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street by William Poundstone

- The Kelly Capital Growth Investment Criterion: Theory and Practice (World Scientific Handbook in Financial Economic Series), ISBN978-9814293495, February 10, 2011 by Leonard C. MacLean (Editor), Edward O. Thorp (Editor), William T. Ziemba (Editor)

See also[edit]

References[edit]

- ^Peter A. Griffin (1979) The Theory of Blackjack, Huntington Press, ISBN978-0929712130

- ^ abcEdward O. Thorp. 'The Invention of the First Wearable Computer'(PDF). Edward O. Thorp & Associates. Retrieved April 26, 2010.

- ^'Founding professor of math donates personal, professional papers to UCI Libraries'. UCI News. UC Irvine. June 12, 2018.

- ^Understanding Fortune's Formula by Edward O. Thorp Copyright 2007 Quote: 'My 1962 book Beat the Dealer explained the detailed theory and practice. The 'optimal' way to bet in favorable situations was an important feature.In Beat the Dealer I called this, naturally enough, 'The Kelly gambling system,' since I learned about it from the 1956 paper by John L. Kelly.'

- ^ abTHE KELLY CRITERION IN BLACKJACK, SPORTS BETTING, AND THE STOCK MARKET by Edward O. Thorp Paper presented at: The 10th International Conference on Gambling and Risk Taking Montreal, June 1997

- ^ abcdeDiscovery channel documentary series: Breaking Vegas, Episode: 'Professor Blackjack' with interviews by Ed and Vivian Thorp

- ^The Tech (MIT) 'Thorpe, 704 Beat Blackjack' Vol. 81 No. I Cambridge, Mass., Friday, February 10, 1961

- ^ ab'American Scientist online: Bettor Math, article and book review by Elwyn Berlekamp'. Archived from the original on April 23, 2007. Retrieved March 18, 2006.CS1 maint: BOT: original-url status unknown (link)

- ^ abcdIt's Bye! Bye! Blackjack Edward Thorp, the pensive professor above, is shaking the gambling world with a system for beating a great card game. He published it a year ago, and now the proof is in: it works David E. Scherman January 13, 1964 pp. 1–3 from SI Vault (beta)(CNN) Quotes: 'The unlikely trio was soon on its way to Reno and Lake Tahoe, where Thorp's horn-rimmed glasses, dark hair and fresh, scrubbed face hardly struck terror into the pit bosses. (p. 1)', 'But Edward Thorp and his computer are not done with Nevada yet. The classiest gambling game of all—just ask James Bond—is that enticing thing called baccarat, or chemin de fer. Its rules prevent a fast shuffle, and there is very little opportunity for hanky-panky. Thorp has now come up with a system to beat it, and the system seems to work. He has a baccarat team, and it is over $5,000 ahead. It has also been spotted and barred from play in two casinos. Could it be bye-bye to baccarat, too? (p. 1)' and 'But disguises frequently work. Thorp himself now uses a combination of wraparound glasses and a beard to change his appearance on successive Las Vegas visits. (p. 3)'

- ^Breaking Vegas 'Professor Blackjack.'Archived December 21, 2008, at the Wayback Machine Biography channel Rated: TVPG Running Time: 60 Minutes Quote: 'In 1961, lifelong gambler Manny Kimmel, a 'connected' New York businessman, read an article by MIT math professor Ed Thorp claiming that anyone could make a fortune at blackjack by using math theory to count cards. The mob-connected sharpie offered the young professor a deal: he would put up the money, if Thorp would put his theory to action and card-count their way to millions. From Thorp's initial research to the partnership's explosive effect on the blackjack landscape, this episode boasts fascinating facts about the game's history, colorful interviews (including with Thorp), and archival footage that evokes the timeless allure and excitement of the thriving casinos in the early `60s. '

- ^'Blackjack Hero profile'. Blackjackhero.com. Retrieved April 26, 2010.

- ^A favorable strategy for twenty-one. Proceedings of the National Academy of Sciences 47 (1961), 110-112

- ^ ab'Poundstone, William: Fortune's Formula : The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street'. Retrieved April 26, 2010.

- ^Anthony Curtis. 'Las Vegas Advisor on Ed Thorp'. Lasvegasadvisor.com. Retrieved April 26, 2010.

- ^Chuck Bower (January 23, 1997). 'Cube Handling in Races: Thorpe count'. bkgm.com. Backgammon Galore. Retrieved May 8, 2013.

- ^'Thorp's market activities'. Webhome.idirect.com. Archived from the original on October 31, 2005. Retrieved April 26, 2010.

Edward Thorp Blackjack

Sources[edit]

Edward Thorp Casino Bingo

- Patterson, Scott D., The Quants: How a New Breed of Math Whizzes Conquered Wall Street and Nearly Destroyed It, Crown Business, 352 pages, 2010. ISBN0-307-45337-5 via Patterson and Thorp interview on Fresh Air, February 1, 2010, including excerpt 'Chapter 2: The Godfather: Ed Thorp'

External links[edit]

- Edward O. Thorp at the Mathematics Genealogy Project

Edward Thorp Beat The Dealer

Four years before the 1962 publication of Thorp's book, he was contemplating ways of beating roulette and had already created the world's first basic-strategy card – those pocket-sized laminated rectangles that tell players each correct play to make in blackjack. As related in his new book, 'A Man For All Markets,' in 1958 Thorp and his wife decided to spend their Christmas holiday in Las Vegas, playing a bit of blackjack.

At the time, blackjack was a pursuit in which players had no shot at winning money over the long run. In fact, they were likely to lose lots of cash as a result of random, shoot-from-the-hip play. Enmeshed in the world of games and math, though, Thorp had been made privy to an approach for playing blackjack – which later became known as 'basic strategy' – that had been devised by four men in the US armed forces. It reduced the house edge to .62-percent.

Thorp sat down with a bankroll of $10 and his homemade card that told him what to do with all possible hands against every dealer up-card. He had $8.50 left before quitting – and becoming optimistic about conquering the game by learning in his own way how to play it. Dealers and fellow players laughed at him for consulting his card and making plays – hitting with a soft 18 against the dealer's 9, for example – that seemed silly then but is the norm now. 'The atmosphere of ignorance and superstition surrounding the blackjack table that night had convinced me that even good players didn't understand the mathematics underlying the game,' he writes in his book. 'I returned home intending to find a way to win'.

In the library of UCLA, where he toiled in the math department, Thorp worked numbers and reached the breakthrough conclusion that the game of blackjack changes based on cards remaining to be dealt. In 1959, Thorp snagged a professorship at Massachusetts Institute of Technology. After learning to program on the school's mainframe computer, he created a system for keeping track of cards that had already been dealt, betting higher when the remaining cards presented advantages for players, betting lower otherwise and deviating from basic strategy when the math deemed that such a move would be correct.

In short, he came up with the system that card counters still use today. By 1961, after Thorp went public with his findings, he teamed up with a pair of New York businessmen who were eager to back a test-run in Reno, NV. They put up a total of $10,000 (equal to 80,000 in 2016 dollars). In short order, Thorp was spreading from $50 to $500 in a single-deck game that was dealt to the bottom. Uncomfortable with his winning ways, casino owners demanded that their dealers shuffle as often as necessary to prevent the mathematician from consistently winning. Clearly, Thorp's system worked.

After a few days, though, he experienced the bane of every card counter who'd go on to follow him. 'The casino had barred us from play,' he writes. 'I asked the floor manager what this was all about. He explained, in a friendly and courteous manner, that they had seen me playing the day before and were puzzled at my steady winning at a rate that was large for my bet sizes. He said that they decided that a system was involved.'

They were right. In the end, it yielded $11,000 of profit via just 30 hours of play (this would be today's equivalent of an $88,000 profit, nearly $3,000 per hour). By the summer of 1961, Thorp was writing 'Beat The Dealer,' a book that would introduce the world to his breakthrough strategy for playing blackjack with a mathematical edge that turned the tables on the casinos. The book became a bestseller. Legions of blackjack fanatics followed its concepts and earned fortunes.

But the casinos did not take well to losing and Thorp, who began teaching at University of New Mexico, took to wearing disguises in order to thwart eagle-eyed pit-bosses and security personnel. He and his book got written up in Sports Illustrated and Life magazine. Bookstore owners couldn't keep it on their shelves. Freaked-out casino magnates held a secret meeting at the Desert Inn to try figuring out what to do about Thorp and those who had been inspired by him. Sin City's local newspaper, The Las Vegas Sun, retaliated with a story attempting to debunk card counting.

Obviously, the reporter was wrong. In the wake of Thorp's book, blackjack teams – like the famous MIT Team, immortalized in the movie '21' – formed and flourished. Advanced gambits, such as the Big Player strategy (in which someone slips onto the table, betting only when the count is positive), made profits soar and left maneuvers difficult to detect. As Thorp writes, 'I found myself barred, cheated, betrayed by a representative of the gaming control board and generally persona non grata at the tables. I felt satisfaction and vindication when the great beast panicked. It felt good to know that, just by sitting in a room and using pure math, I could change the world around me'.

By 1964, as advantage play spiked, Thorp forsook blackjack for a bigger challenge: the casino known as Wall Street. Having recognized that 'gambling is investing simplified,' he went on to beat that larger, more challenging game, reaping sums of money that capitalize on inefficiencies and make advantage-playing profits look like chump change. Clearly, as he has proven via successful runs against blackjack and the stock market, 'Great investors are often good at both'.